Should I pay my credit card off in full?

Expanding off of this term, fintech is now most commonly applied to non traditional banking institutions. 66%, which is good and meets the recommendation for below 30%. “We’re taking a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin,” said CEO Elon Musk. With Dime Alley, we process everything for you quickly and hassle free, and, if approved, you could be receiving your loan in less than 24 hours. The ZR2 trim adds off road prowess to Chevrolet’s three quarter ton Silverado. You hereby consent to CLIENT being appointed as your authorised representative to receive your Credit Information on an ongoing basis until the i for the purpose of determining credit worthiness of consumer through using Provider’s Credit Information Report and sharing relevant credit products with the consumer; and ii in relation to credit monitoring that enables the Individual Consumers to monitor various active loan products, new enquiries, movement of credit score, delayed payments flags etc. Installment loans are loans you repay in equal payments over months or years. However, in no event, will the Department require an installment lender licensee to carry more than $100,000 in total coverage. Loans feature repayment terms of 24 to 84 months. The credit bureau that provided the initial report to the company that denied credit must provide the report. By understanding your story, how you got where you are today and your plans for the future, your underwriter will be your advocate and assist you throughout the review process. Although you’ll still only fill in a single and straightforward application, it will compare your circumstances to the criteria of over fifty lenders. MoneyMe helped me out when no one else would and they have been a delight to deal with. Minimum down payment, loan term, and interest rates are also not listed on their website. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of OppFi. Instead, the lender deposits the loan amount into a secure savings account controlled by the lender. Important Disclosures. Certain restrictions and conditions apply. Bad Credit Unsecured Same Day Loans. This might sound great in principle, but rollovers involve additional costs and charges which can often make things more difficult. Furthermore, many P2P lending platforms use sophisticated risk assessmenttechniques to reduce the risk of default and protect lenders’ investments. One is that they have limited loan amounts and terms.

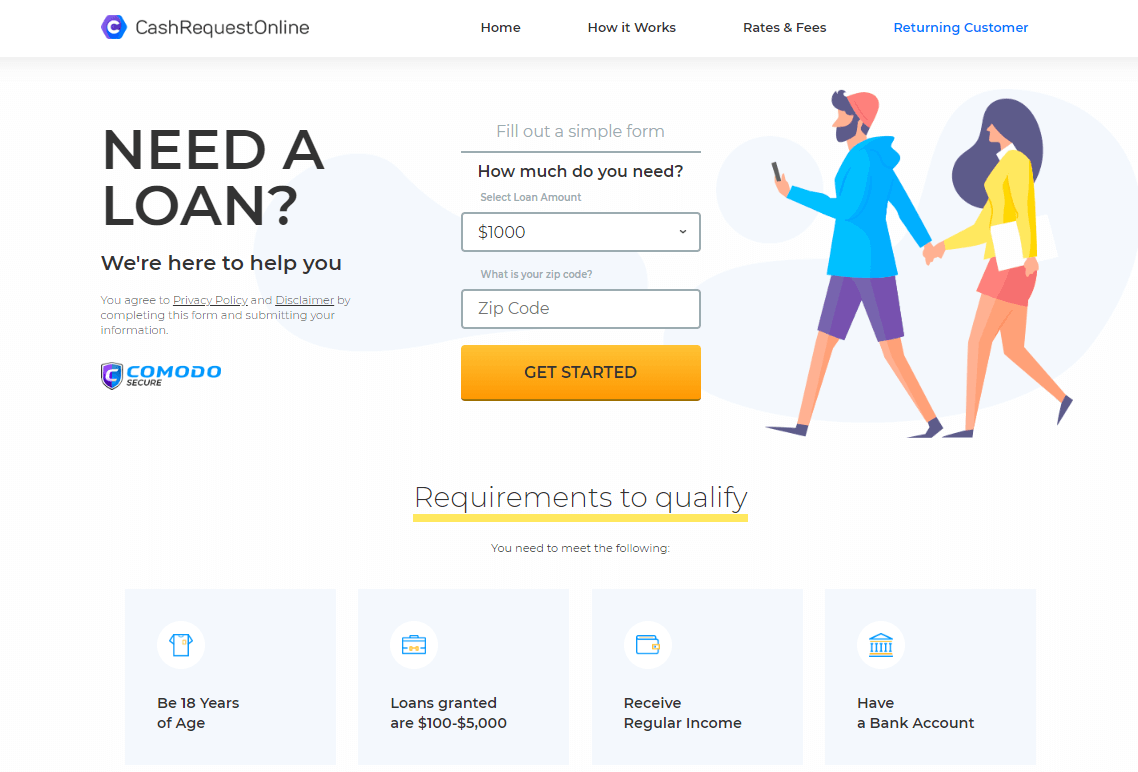

Apply for a Bad Credit Loan!

However, keep in mind that their job is to market a loan; your job is to repay it. The table below shows how your loan costs can vary when these factors change. So what are you waiting for. No credit check loans have an easy application process and are typically approved very quickly, allowing borrowers to get a loan without any worry about credit history. You may be wondering whether it is possible to have two title loans at the same time. You’re seconds away from stepping into your next vehicle. A payday loan online that doesn’t require a hard pull on your credit report. To further boost your cash flow you can consider clocking in overtime hours at work or getting a side job. Responsible lending is our priority so we carry out credit checks on all loans to make sure we aren’t lending to anyone who can’t afford it. It won’t take long to complete your application on the Rixloanswebsite. I understand it could be quite challenging to get a loan when you are receiving benefits however you still have options that you can consider. When you are ready to begin an application, click apply now. The Biden administration launched their “Fresh Start” initiative in April 2022 to move borrowers who were in default prior to the pandemic into good standing — though borrowers must apply for the program. Installment loans are loans you repay in equal payments over months or years. Best to meet your immediate financial requirements. What is persistent debt. But the Trump administration rejected the argument that consumers needed protection, and the CPFB revoked the underwriting rule in 2020. This cannot be guaranteed, but this way you can ensure your repayments will not fall into arrears and get marked as late, helping your credit score avoid dropping further. Your usable equity is how much of your equity you can access as a loan. As you’ll see below, you will want your website to embed widgets from the loan affiliate company, have blog content, and create an e mail sales funnel.

Apply For A Loan Online

The reason CashUSA’s official website is considered as one of the most trustworthy ones in the lending sector is because it is incredibly transparent and honest about its services. Borrowers are directly connected to lenders by Money Mutual. Loan term – this is the most notable, and most important, distinction between payday loans and short term loans. Trusted by thousands of Australians. A: There is no one size fits all answer to this question, as eligibility for a bad credit loan will vary from lender to lender. Personal loans can be used to do things like consolidate outstanding debt, make home or Get Up and Go car repairs, or pay an unexpected bill. Please check your email and let us know if you have any questions. Responsible lending is our priority so we carry out credit checks to make sure we aren’t lending to anyone who can’t afford it. As a direct lender, we will always try our best to fund you a loan that suits your need, regardless of how good or bad your credit is. By clicking on the link, you will leave our website and enter a site not owned by the bank. The APR on payday loans and cash advances is very high. The safest way to use loan apps is in one time emergencies because fees can add up and they may encourage repeat borrowing. We’ve enhanced our platform for chase. Read our privacy policy for moreinformation. Please see Prosper’s Privacy Policy, WebBank’s Privacy Policy, Coastal Community Bank’s Privacy Policy, and Spring EQ’s Privacy Policy for more details. P2P lending canprovide lenders with a number of advantages, including the ability to earnhigher returns on their investments than traditional savings accounts or bonds,increased control and transparency over their investments, and a broader rangeof investment opportunities.

Apply online

Payday lenders may ask for a bank account, but sometimes a prepaid card account may be enough to qualify. Cash advance loans perhaps marketed to help people to connect the space between their unique money and unanticipated costs. How to Avoid Bank Overdraft Fees. To be eligible to for a QuidMarket loan , you will need. Dba Check City Check Cashing, a payday lender, is licensed by the Virginia State Corporation Commission. The main drawback of no credit check loans is the potentially higher cost associated with them. Some states offer consumer protections for title loans — and for good reason. In most cases, consumers write a post dated, personal check for the advance amount, plus a fee. In October 2017, Payday UK and Payday Express stopped lending.

Paying extra on a loan calculator

The sliding payment graphic above is for demonstrative and marketing purposes only. Self repaying loans might sound too good to be true, but thanks to some clever smart contracts, the developers at Alchemix have pulled it off. Where we are satisfied information is inaccurate, we will take reasonable steps to correct the information within 30 days, unless the individual agrees otherwise. Always my go to when we need a little help especially during these times. The reality is this: they likely haven’t been in a situation where they have less than perfect credit and need cash now. Step 1: Choose how much you need and how long you want to repay. Enter your registered email address to request a password reset link. You can object to this profiling at any time by contacting us. Offer pros and cons are determined by our editorial team, based on independent research. While Goddard, 45, considers himself “one of the lucky ones” who would qualify for $20,000 of debt relief, the cancellation wouldn’t make too much of a dent in his more than $150,000 balance. Be sure to read the fine print carefully and make sure you understand all of the terms and conditions. BadCreditLoans is a reliable provider of best online payday loans, offering competitive rates and swift approval. Interest is calculated and credited monthly. Get funded as fast as just minutes. Since the monthly payment is the most common payment schedule, in our discussion we will assume the frequency of payments as monthly. When comparing lenders, be sure to do your research and make sure you find a reputable lender. The annualized rate varies significantly, encompassing both the lowest and maximum rates. Emergency loans were designed to help you out when all you need is a couple of hundreds of dollars until your next paycheck. They may then get into serious financial difficulties if they cannot cover the loan, and this will have a negative impact on their credit rating/history. We are an active member of the OLA Online Lenders Association. You must be at least 18 years old. It can find consumers the best loans based on their circumstances including those with bad credit, through a simple 5 minute application process, with loans starting from $1,500. The Small Multifamily Affordable Loan Program SMAL is designed to increase the supply of affordable rental housing for lower income individuals.

Quick links

Borrowers who seek out loan options like these are obviously those who don’t have a standard 9 5 job or who are currently unemployed. Sign up with our free app and access your account anywhere. Additionally, this article is meant to provide information and not financial advice. First off, we approve 9 out of 10 applicants, so you have a good chance of being approved for a short term loan with bad credit or no credit at all. So, if you earn $2,000 per month, the most you could borrow from a payday lender is $500. BadCreditLoans Offers Guaranteed Approval For Instant Payday Loans Online. Best experience I have had with a loan company. Finances can be overwhelming. Tennessee is third, with 1,344. If we can’t fund you the loan ourselves, with your permission only, we evaluate offers from over 40 UK lenders and high street banks to make sure you get the highest chance of approval possible. Ihr benötigt einiges an Vorarbeit, denn die günstigsten Gegenstände an einer Farm bringen eher wenig Silber ein. Or pay off that debt.

Disclosure

“Whether earned wage access is on net helpful or on net harmful is unknown,” he said, and it’s yet to be determined if these tools provide a pathway to a whole paycheck, or whether they will replace more expensive options. If you cannot pay back the lender, you might lose your car. This solution isn’t suitable for everyone though – and remember that applying for another account can lower your credit score. You’ll also need to provide some personal information. If you’ve got lots of different credit commitments and you’re struggling to keep up with repayments, you can merge them together into one loan to lower your monthly payments. 1% Cash Back on other purchases. This Agreement will be effective until you tell us that you no longer want to receive Documents electronically by sending notice in the manner described in Section 4 below. Under Straightforward Premises Application process is simple and private Financial institutions are distributed through a system Long term employment in one’s chosen field Information security via encryption Cons GreenDayOnline is only available to residents of the United States. Before you get a loan, you should understand the process of getting one. Anna holds an MA in Middle Eastern studies from the American University of Beirut and a BA in Creative Writing from Macaulay Honors College at Hunter College, CUNY. Now that you understand how to apply for a $100 payday loan, where’s the best place to find the funding you need. This is a type of collateralized loan that allows users to borrow up to a certain percentage of deposited collateral, but there are no set repayment terms, and users are only charged interest on funds withdrawn. ²EMP = Estimated Monthly Payment. Louis Cardinals fan and eager if haphazard golfer, Tom splits time between Tampa and Cashiers, N. Bankrate’s editorial team writes on behalf of YOU – the reader.

Excellent service

Mortgage brokers may save you time by researching available mortgage options for a fee. You take out a loan to pay for the car upfront, then make monthly payments to your lender to repay the amount borrowed plus some interest. With the Brigit loan app, you can get an instant loan up to the amount of $250. The short application process, flexible repayment terms, and reasonable interest rates make it an attractive option for borrowers. Here’s some extra information. Lenders use this metric to assess borrowers because it indicates your financial capacity for additional debt payments. Or as if you’d never be able to make that credit card or energy bill payment. At Cashfloat we conduct a thorough credit check on all our applicants. For example, common stockholders can vote while preferred stockholders generally cannot. The credit limit that is sanctioned depends upon the account holder’s relationship with the bank, credit history, cash flows, and repayment history if any. A debt consolidation loan is designed to group your high interest loan balances into one lower interest loan. What do you need to borrow the money for, and how much do you need. This can help you which you are refused. Lenders will probably be prepared to assess the application of someone who is unemployed or on benefits but they will conduct a detailed affordability check. If you’re struggling to pay back money you owe, the first thing to do is to work out what you can actually afford to pay by doing a simple budget. Do you want an appraisal. You can even purchase their credit monitoring service, which will keep you updated and alert you of any suspicious activity in your account. Top 10 Best Bank for Home Loan In India. It is important to note that lending is a very profitable fintech sector, where 28% of the top 50 fintech companies operate. $1 monthly membership fee.

Latest Reviews

These are slightly more complex, but could still payout within 24 hours if you have all the necessary information to hand. Swift Money provides a convenient way for customers to apply for the money they need from the comfort of their own homes. Credit scores and credit history help lenders determine how much credit they will offer and at what interest rate. The Federal agency that administers compliance with this law concerning this creditor is the Consumer Financial Protection Bureau, 1700 G Street NW, Washington DC 20006 and the Federal Trade Commission, Equal Credit Opportunity, Washington DC 20580. Date of experience: April 27, 2022. Our customer service representatives are available for you via phone, email or live chat. From a mathematical standpoint, it looks like this for a 15% loan: 375 x. Target Market Determination. Are you in a bind and need cash fast. Apply for an Installment Loan to easily meet the cash needs of your business, and benefit from favorable interest rates and flexible repayment plans. Updated: 31 Mar 2023 2:40 pm. Of the proposed rules. Very personable and they make the process of relieving a financial setback very smooth. Peer to peer P2P loans type of direct lending of money to someone or a business without an official financial institution acting as the go between. APRs can be high: Personal loans can be an expensive borrowing option for borrowers with bad credit or no credit. Considering monthly interest rates alone, credit cards vs payday loans are cheaper. $0 Establishment fee on an Unsecured Fixed Rate Personal Loan when you apply and fund by 1 June 2023. When it comes to finding quick and easy financial solutions, small payday loans online no credit check are an ideal option. Bank loans are traditional unsecured personal loans that are usually only available to those with strong credit records. Before signing the electronic installment loan documents, all terms and conditions will be made available for study. Once approved, your cash could be sent within minutes. Apply online using our secure application process. Real Estate Investing. There are no minimum credit score requirements to obtain a federal student loan and with the exception of the Direct PLUS loans for parents, graduate students and professional students, there is no credit check involved. I was surprised to get such a quick response for approval. Need to talk to us directly. Privacy notice Terms and conditions Cookies / Manage Sitemap. During an initial meeting, counselors learn more about a person’s financial situation. Here we’ll cover these two. There are two basic types of home loans.

Find out more in our guide Borrowing from a credit union

The less time you have to pay back the loan, the higher your APR. For Customer Service, please contact us at 1 800 745 1011. PAL loan APRs are capped at 28%. Simple Loan applicants must have an open U. With MoneyMutual, borrowers can access the funds they need quickly and easily, with no hidden fees or long term commitments. At QuidMarket, we offer a flexible alternative to payday advance loans. We encourage negotiations with our lenders for a repayment structure that best meets your financial requirements. When you’re considering a payday loan, or when you’re paying one back, it’s important to understand how they work and know your rights. Strong Pay Check Banking Institutions. The only thing to keep in mind is that the EMI Equated Monthly Instalment should be an amount which you can pay back easily every month. In Georgia, a licensed lender cannot charge more than 10% interest on a loan of $3,000 or less. While many money providing internet sites available to you call for no less than $1000 month to month money. This is known as a ‘hard’ credit check. High interest rates: Online payday loans from direct lenders come with high interest rates and fees. TD Home Access Mortgage:3% down, 30 year fixed rate. Read our full review of Afterpay to learn more.